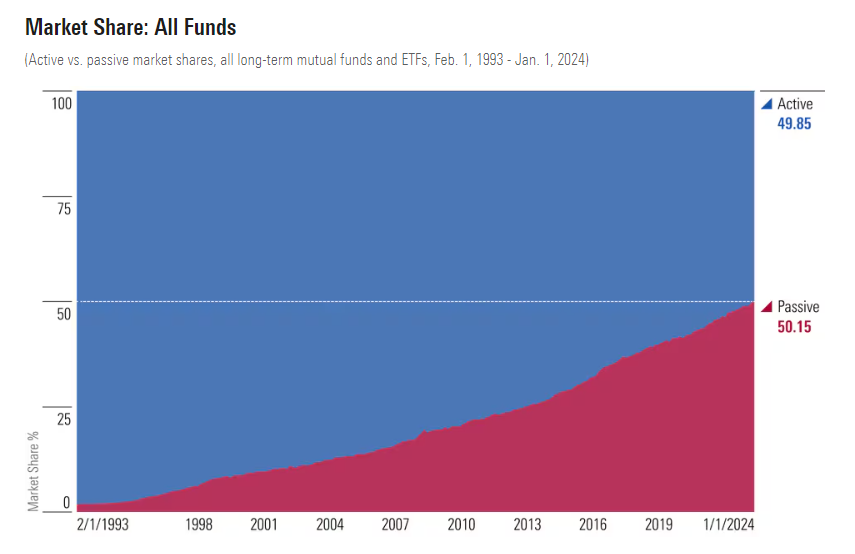

Investing in Global Stock Indexes is so significant that in 2024, for the first time, stock index funds controlled more assets than did their actively managed competitors.

Resource & Insight Center

Index Funds Have Officially Won

Feb 14, 2024

The Long Game

The inevitable at last arrived. Last month, for the first time, passively managed funds controlled more assets than did their actively managed competitors. (This count includes both traditional mutual funds and exchange-traded funds.)

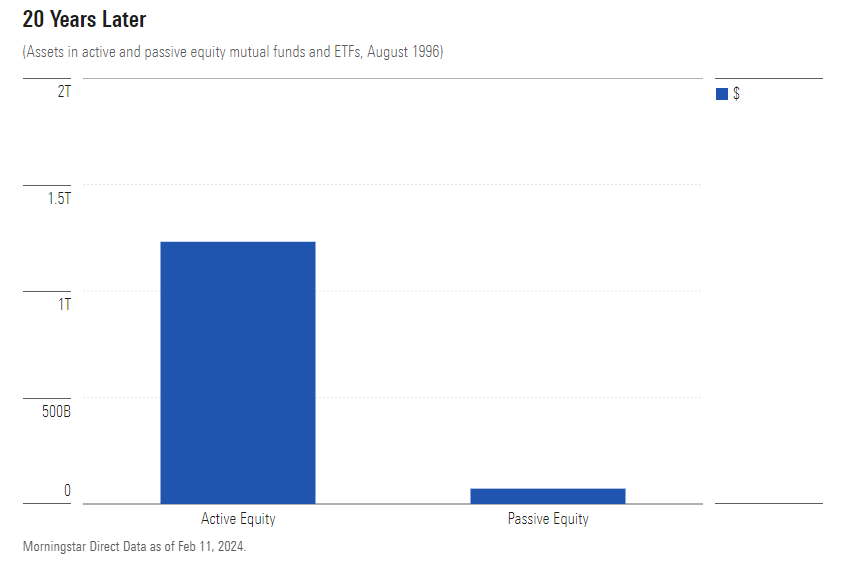

The revolution occurred only gradually. In August 1976, Vanguard introduced the first publicly available index fund. (Wells Fargo already offered a version for its institutional clients.) A private railroad car is not an acquired taste, quipped the English actress Eleanor Robson Belmont. However, index funds certainly were. Twenty years later, fund shareholders barely noticed their existence. Actively run equity funds held far more assets than did indexed stock funds. And there were no passively managed bond or allocation funds.

Warning Signs

But for active management, ill omens lurked. Although retail buyers cared little for indexing, the strategy had by the mid-’90s become the rage among institutional investors. What’s more, Vanguard 500 Index’s VFINX 20-year returns were appealing. Before long, the marketplace would notice that fund’s success. In fact, I ventured at the time, indexing might someday account for as much as … gasp … 30% of the fund industry’s assets.

So much for brash predictions. (And it was considered very brash at the time, earning a pull quote in a Money magazine article.) Not only did index-fund assets exceed the 30% level in 2015, but their market-share growth has accelerated since then. Almost certainly, they will crack the 70% mark during the next decade.

Implications

For the most part, the public discussion of indexing’s ascension has been unhelpful. The prevailing argument, that indexing’s success has distorted stock market prices, is both unprovable and improbable. The second claim is that a handful of index-fund providers have control of too many assets. Perhaps that is so, but what specific threat do they pose? At this stage, that concern is preliminary. Meanwhile, few outside the occupation itself have commented on an actual and profound outcome: indexing’s impact on the financial-advisory business.

The Stock Market

Over the years, investment managers have often complained that indexing’s boom has destabilized equity prices. Unfortunately for the credibility of such objections, they predate indexing’s triumph. When I joined Morningstar in 1988, portfolio managers frequently told me that their funds’ disappointing returns owed to “market irrationality.” At that time, the culprit was “the herd”—which sometimes meant uninformed retail investors and other times trend-following fund managers—rather than indexing. But the line of thought was the same.

At any rate, the argument deconstructs itself. If indexing has made the stock market less rational, that change should represent an opportunity for active fund managers, rather than an obstacle. After all, they have no role to play if equity valuations are fully rational. They are only useful if stocks are somehow mispriced. By this claim, then, indexing has improved active managers’ situations.

Regrettably, it has not. Although indexing has become far more popular than in the past, tens of trillions of dollars remain in the hands of active investors, including a record number of Chartered Financial Analysts. Also, technology has enabled a higher level of investment research, by more parties, than ever before. To be sure, indexing at some point could become so prevalent as to disrupt stock prices. Not yet, though.

Too Powerful?

The second critique, that the leading index-fund providers have become too dominant, is more substantial. Unlike the previous assertion, it is not old wine repackaged in a new bottle. Portfolio managers have carped since Caesar crossed the Rubicon—well, almost—about how the markets’ foolishness caused them to underperform. But not in American history have so few controlled so much money, possessed by so many. The percentage of U.S. equities held by the leading index-fund providers, in particular Vanguard and BlackRock BLK, is unprecedented. We have not been here before.

Second, Jack Bogle himself advanced the thesis. It’s one thing for active managers to attack their highly successful rivals and quite another for the criticism of indexing to come from the strategy’s chief proponent. The issue deserves its due.

The difficulty, as Bogle conceded, is that at least for now, the objection is theoretical. It seems unwise to permit a handful of companies to hold a large minority of U.S. equities. What, however, is the practical danger? The closest that anybody has come to identifying a problem has been an argument that index-fund providers are too soft on corporate managers, but that allegation is difficult to prove. Also, most shareholders vote as CEOs desire. If corporate managements are permitted too much leeway, index funds are scarcely the only reason.

Financial Advice

As my co-worker Syl Flood reminded me, indexing has most substantially affected the financial-advice industry. The growth of indexing forced a business that had primarily marketed itself for its expertise in investment selection—first stocks, then funds—to reinvent itself. Not all advisors were pleased. Over the years, dozens of financial advisors fretted to me about the possibility that indexing would ruin their business, because if they couldn’t offer their customers something better than the obvious investments, who would need their services?

A whole lot of people, as it turned out. The financial-advice industry hasn’t skipped a beat. Today, as then, most older investors who have accumulated substantial assets seek professional help. The industry’s continued success demonstrated that what investors truly needed was not better funds. (Although with low-cost index funds, they usually got them.) They needed better service. They needed advisors who thought more about their needs and less about products. They needed advisors who devoted more time to their goals, risk tolerances, and tax situations.

The financial-advisory business has obliged. Not entirely, of course. Progress is inevitably fitful. But I am confident in stating that today’s financial advisors are, on average, superior to those whom I first met, 35 years ago. Index funds played a critical role in the industry’s improvement. They helped both advisors and their clients to appreciate what was truly important.

Future Implications

This experience, I believe, will be repeated with artificial intelligence. Quite naturally, many financial advisors are worried that they will be replaced by AI routines. But that fate seems to me unlikely. Just as advisors adapted to index funds’ dominance by redefining their roles, so will they evolve in response to artificial intelligence. The tools have become ever cheaper (index funds) and ever more sophisticated (AI programs). In the end, though, they are just that: tools.

That strikes me as a lesson for every occupation. It’s too late for me to redefine my career, nor do my finances require me to do so. Were I 40 years younger, though, I know how I would proceed. I would not be concerned with obtaining specific knowledge. Whatever I learned, AI could mimic in a microsecond. Rather, I would think very long and very hard about what expertise I could develop that an AI program could not. How might I feed on AI, so that it would not feed on me?

A bit far afield from this article’s original topic, I realize. But if there’s one thing that indexing’s victory demonstrated, it is that revolutions have consequences. Better to anticipate the changes that disruptions create than to chase them.